Tax Preparation Services

WE HAVE THE TALENT, KNOWLEDGE, AND SKILL TO FILE TAXES FOR ANY BUSINESS, CORPORATION, NON-PROFIT ORGANIZATION, OR INDIVIDUALS.

Most taxpayers are quite familiar with the complexity of doing taxes as it is a daunting task that involves a lot of documents, receipts, forms, and other important tax issues.

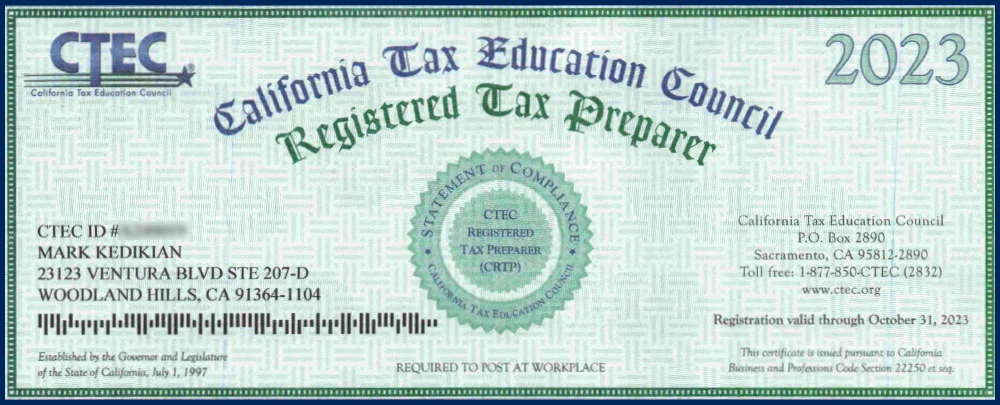

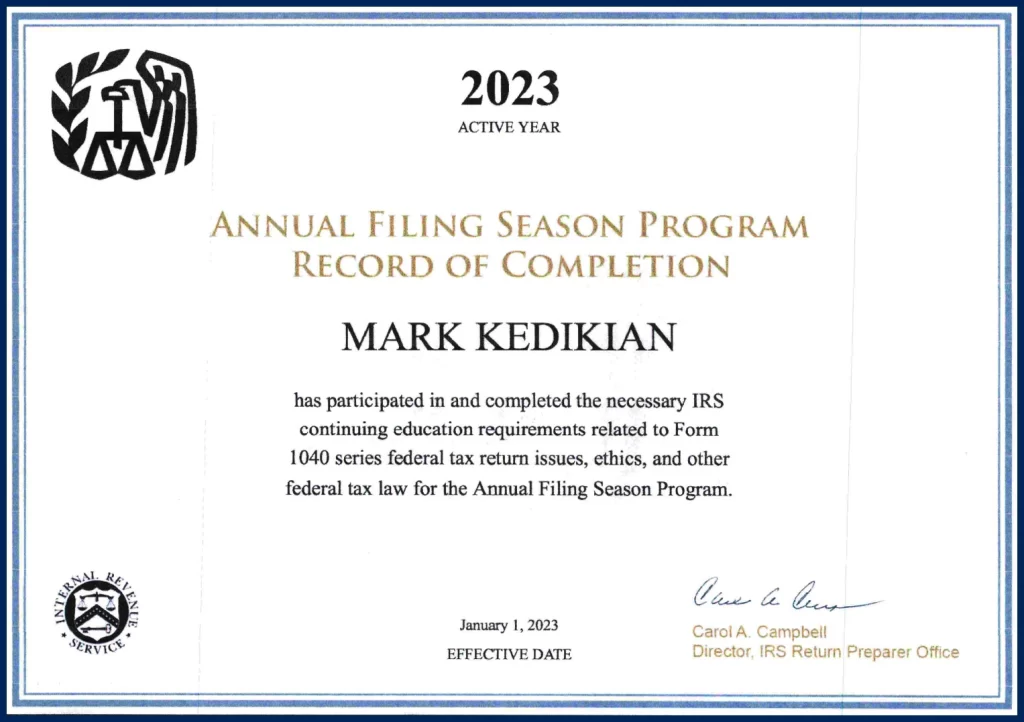

It is especially difficult to do calculations for tasks that you are deeply unfamiliar with. Therefore, Tax Preparation is usually carried out by a CPA, who may be an expert in this area, but is often too expensive to hire.

Since we do not have the overhead expenses of CPA’s, we offer the same level of proficiency for more reasonable fees.

FEDERAL

- Individual Income Taxes

- “C” Corporation Income Taxes

- “S” Corporation Income Taxes

- Partnership Income Taxes

- Fiduciary Income Taxes

- Non-Profit Corporation Taxes

STATE

- Individual Income Taxes

- Corporation Income Taxes

- Partnership Income Taxes

- Charter/Franchise Taxes

If you’d like to receive more information about our Tax Services,

Please call (818) 835-9332

or send an email at: info@marcobookkeeping.com

Tax Services

- Individual (simple income tax returns)

- Corporate

- Partnership

- S Corp

- LLC

- Trust

Notary Services

- Jurats / Oaths / Affidavits

- Notarizations on Loan

- Document Signing

- Acknowledgments

- California All-Purpose

Business Services

- Small Business Accounting

- QuickBooks Services

- Billing and Account

- Receivable / Payable

- Full Payroll & Payroll Tax Services

- Bank reconciliations

- New Business Formation

- Non-Profit Organizations

- Financial Statements

Personal Bookkeeping

- Manage personal finance

- Track Income / Expense

- Pay bills on time

- Budget your money