Payroll

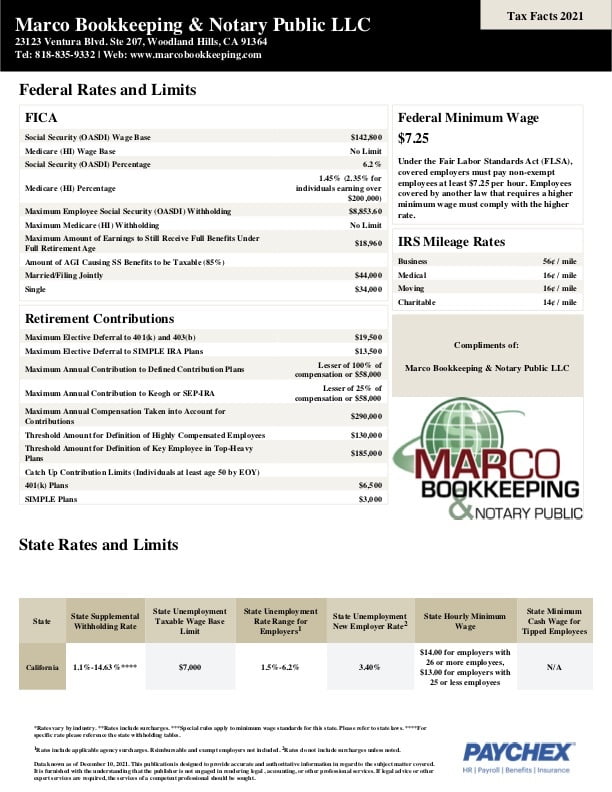

Federal Rates and Limits

FICA

- Social Security (OASDI) Wage Base $142,800

- Medicare (HI) Wage Base No Limit

- Social Security (OASDI) Percentag 6.2%

- Medicare (HI) Percentage 1.45%

(2.35% for individuals earning over $200,000)

- Maximum Employee Social Security (OASDI) Withholding $8,853.60

- Maximum Medicare (HI) Withholding No Limit

- Maximum Amount of Earnings to Still Receive Full Benefits Under Full Retirement Age $18,960

- Amount of AGI Causing SS Benefits to be Taxable (85%)

- Married/Filing Jointly $44,000

- Single $34,000

Retirement Contributions

- Maximum Elective Deferral to 401(k) and 403(b) $19,500

- Maximum Elective Deferral to SIMPLE IRA Plans $13,500

- Maximum Annual Contribution to Defined Contribution Plans Lesser of 100% of compensation or $58,000

- Maximum Annual Contribution to Keogh or SEP-IRA Lesser of 25% of compensation or $58,000

- Maximum Annual Compensation Taken into Account for Contributions $290,000

- Threshold Amount for Definition of Highly Compensated Employees $130,000

- Threshold Amount for Definition of Key Employee in Top-Heavy Plans $185,000

- Catch Up Contribution Limits (Individuals at least age 50 by EOY)

- 401(k) Plans $6,500

- SIMPLE Plans $3,000

Tax Facts 2021

Tax Facts 2021

Federal Minimum Wage

$7.25

Under the Fair Labor Standards Act (FLSA), covered employers must pay non-exempt employees at least $7.25 per hour. Employees covered by another law that requires a higher minimum wage must comply with the higher rate.

IRS Mileage Rates

Retirement Contributions

| State | State Supplemental Withholding Rate | State Unemployment Taxable Wage Base Limit | State Unemployment Rate Range for Employers1 | State Unemployment New Employer Rate2 | State Hourly Minimum Wage | State Minimum Cash Wage for Tipped Employees |

| California | 1.1%-14.63%**** | 7,000 | 1.5%-6.2% | 3.40% | $14.00 for employers with 26 or more employees, $13.00 for employers with 25 or less employees | N/A |

- *Rates vary by industry. **Rates include surcharges. ***Special rules apply to minimum wage standards for this state. Please refer to state laws. ****For specific rate please reference the state withholding tables.

- 1Rates include applicable agency surcharges. Reimbursable and exempt employers not included. 2Rates do not include surcharges unless noted.

- Data known as of December 10, 2021. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is furnished with the understanding that the publisher is not engaged in rendering legal , accounting, or other professional services. If legal advice or other expert services are required, the services of a competent professional should be sought.

News Updates

Why Using a Professional Notary in Los Angeles is Essential

December 11, 2024

In Los Angeles, ensuring that important legal documents are properly notarized is crucial. Whether you’re closing on a property, signing

Accounting, Bookkeeping, and Tax Services: A Personalized Touch for Every Client

December 11, 2024

At MarCo Bookkeeping & Notary Public, LLC, we offer expert accounting, bookkeeping, and tax services with a commitment to professionalism

Don’t Let Scammers Ruin Holiday Gift-Giving: Protect Yourself from Gift Card Scams

December 4, 2024

Don’t Let Scammers Ruin Holiday Gift-Giving: Protect Yourself from Gift Card Scams The holiday season is a time for joy,