Notary public

About Our Notary Services

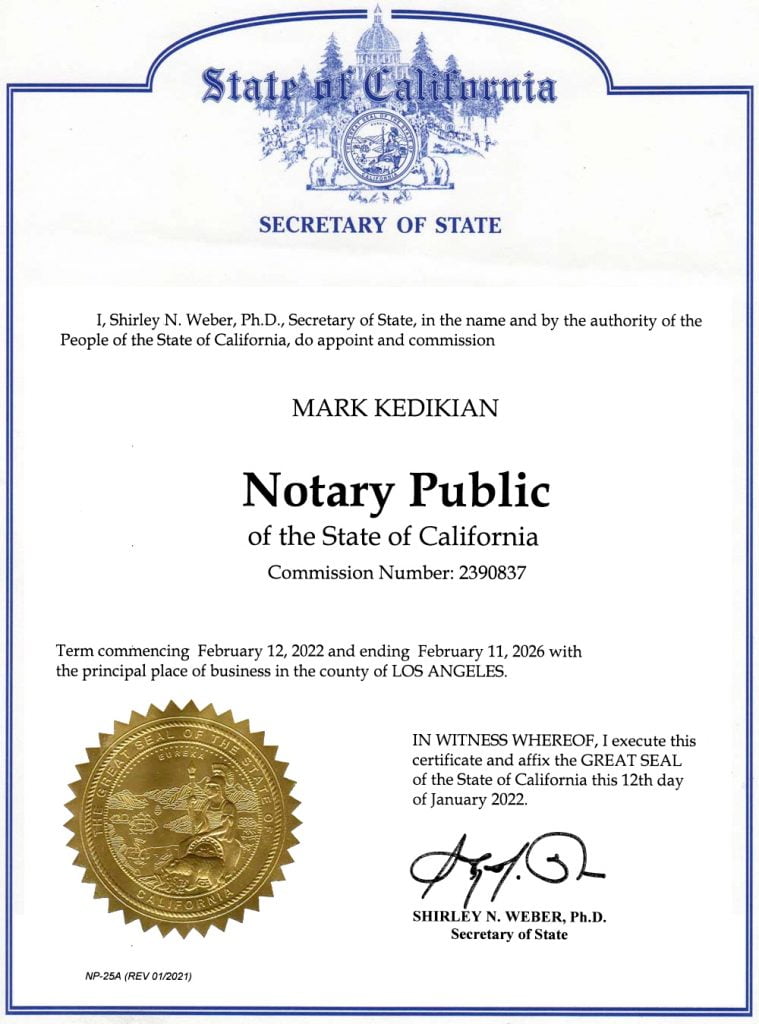

We are the leading notary service provider in Woodland Hills since 2007. Over the years, we have earned a reputation of excellence with professional, prompt, and reliable services. We are honored to be trusted with tens of thousands of notarizations every year, while still delivering personalized service. Marco Bookkeeping & Notary Public is committed to saving you time and money, our commitment to customer satisfaction never waivers.

To best serve your needs, our notary publics are ready to travel to you virtually anywhere in Los Angeles, or you can come to our office and sign your documents in our private meeting room.

The prices for many of our services are on our website. Of course, prices may vary for special requests; we welcome price inquires prior to scheduling service. We offer discounts for multiple documents that require legalization authentication or apostille.

Most notary publics are either commissioned or established in Los Angeles County, also allowing us to quickly authenticate documents for international reasons. We have extensive experience with the requirements of many of the consulates.

As a full-service notary provider, we offer walk-in and appointment services at our convenient midtown office, witness services (appointment recommended), as well as temporary and permanent notary staffing. We welcome your inquiry and look forward to the opportunity to serve you.

As a member of the Notary Public Administrators, a section of the National Association of Secretaries of State, we help with the advancement of best practices and procedures of all Notary Publics through education and peer to peer collaboration with both governmental and private organizations.

News Updates

Why Using a Professional Notary in Los Angeles is Essential

In Los Angeles, ensuring that important legal documents are properly notarized is crucial. Whether you’re closing on a property, signing

Accounting, Bookkeeping, and Tax Services: A Personalized Touch for Every Client

At MarCo Bookkeeping & Notary Public, LLC, we offer expert accounting, bookkeeping, and tax services with a commitment to professionalism

Don’t Let Scammers Ruin Holiday Gift-Giving: Protect Yourself from Gift Card Scams

Don’t Let Scammers Ruin Holiday Gift-Giving: Protect Yourself from Gift Card Scams The holiday season is a time for joy,